At 2 years old, my oldest’s concept of money education contained three things: 1) mommy goes to work, 2) work brings money, and 3) money brings toys. It set the foundation of her understanding of the importance of money, as well as a sense of respect for her parents’ work.

Fast forward to 2021, the kids were now older, and we were navigating assigning responsibility for chores, as well as dealing with behavior issues. In an effort to promote positive discipline, we bought a reward chart from Amazon and introduced a “reward” system to our house.

When we first started using the reward system, we offered many different reward options for our kids. But over time, we came to learn that “a trip to a dollar store” has become the all-time favorite reward choice. This is great, because it is such a creative and practical way to introduce our kids to budgeting and money education while applauding good behavior at the same time. Here is how we do it at our house:

Set Up Your Reward System:

-

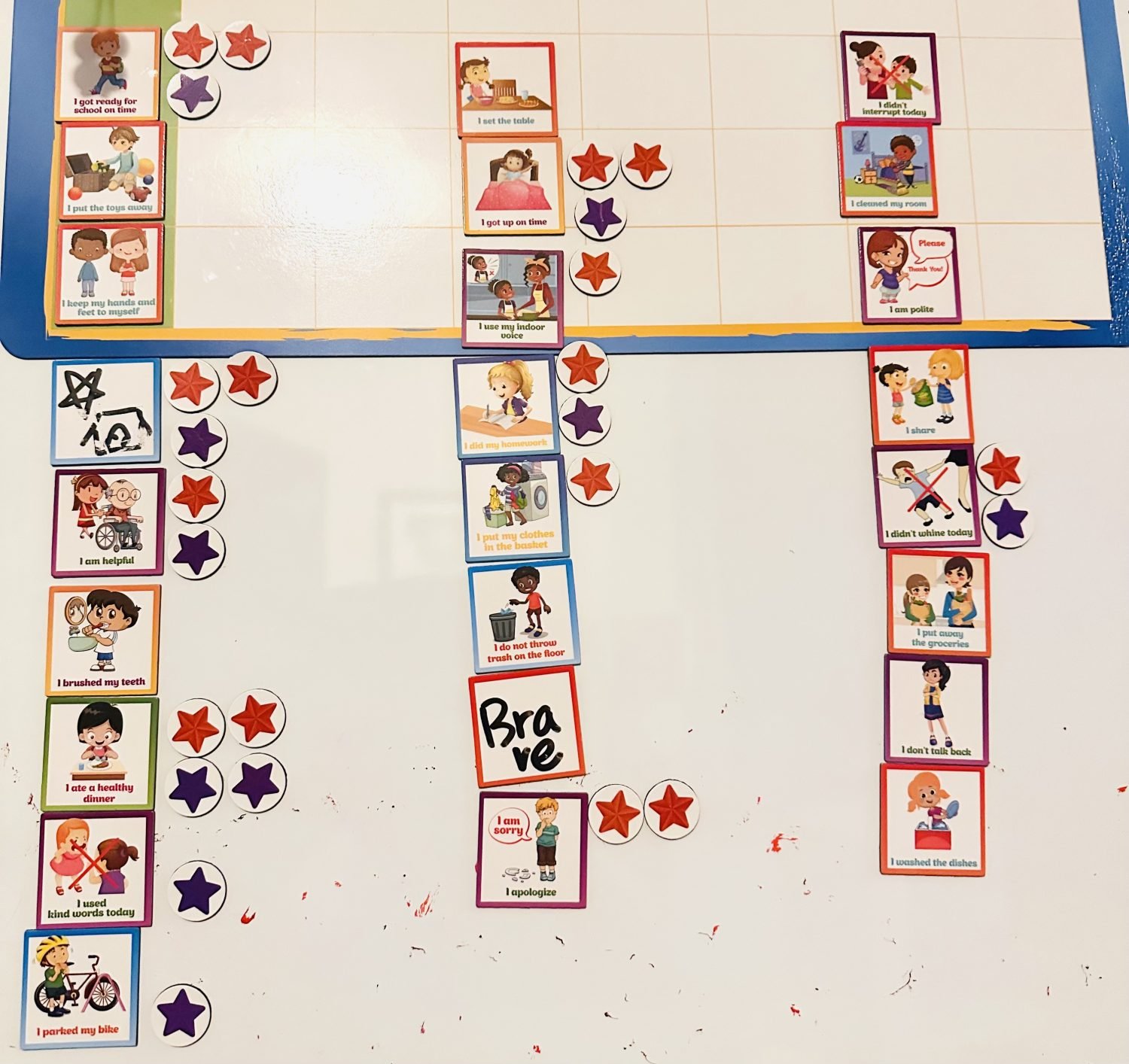

Establish the actions/tasks that you want to reward your child for doing.

These can be related to chores, good behavior, or school performance. Some actions can be clear, like doing chores, while others can be 100% dependent on parental decisions. Make sure these are achievable ones. You will want to have a good mix of complex tasks and some “guaranteed” tasks that are easy to complete. It is also important to remember to keep these as fluid as possible. Though we tried introducing the daily chore star system, it just ended up over-complicated everything and wasted too many counting stars.

At our house, we set a rule of a minimum of 10 stars for a redeemable reward. Every time they achieve a specific action/task, they earn a star. There is no limit on how many stars they can earn per task.

Besides some common ones, we created a Star Action for anything we can’t find a defined action with! -

Consider adding layers of reward levels.

To educate kids on the concept of saving for greater rewards, we set a 30-star level where instead of $5 at the dollar store, they get $15 for a trip to Walmart. This additional level allows them to save up for bigger prizes (and more fun toys), learn to read price labels and calculate their spending in real stores (compared to dollar stores, where everything is the same price), and reduces the number of dollar store trips we have to make.

Going to the Store:

-

Set your budget.

Allocate a specific amount of money for your child’s reward. This should be a fixed number every time. If your children are young, they may not grasp the concept of how many items they can afford. This is where I like to take them to dollar stores, where $5 dollars can easily translate into four to five items.

Keep it simple, budget in the tax and cover the taxes for them.

-

Judgment-free shopping.

The whole purpose of our money education and budgeting practice is to understand how much you have to spend. Let them pick anything they want that fits within their budget. Leave the lessons on priority purchasing and product value for a different time.

-

Engage them at check out.

When it’s time to check out, let them bring the items to the cashier. If paying by cash, let them hand the money over to the cashier. Most importantly, let them hold their bags/items as you leave the store. Keep them excited about their purchases – and it’s one less thing mommy has to carry.

If you have more than one kid….

-

Try to balance the pace of their reward collection.

Using a reward chart should be a positive reinforcement. The last thing you want is to have one kid left out of the dollar store trip, creating extra drama because of jealousy. It is important to remember that you DO NOT need to redeem their rewards right away. For example, there were many times I would purposely wait until both of my children had collected enough reward stars before we would visit the store.

-

Try introducing the concept of a fund pool.

Sometimes there will inevitably be some items they want that are out of their budget. With a little guidance from you, you will be surprised how well your children can team up and work together to pursue a common goal.

Final Note – Teach them to live FRUGALLY

Teach them to understand discounts, coupons, and price comparisons as part of their financial education every day. On our last trip to Walmart, my daughter was able to scout and swap an expensive Barbie for a cheaper Barbie, and have extra money left to spend on Barbie’s accessories!

This kind of hands-on approach to money education and budgeting helps my children learn about setting goals, making choices, and managing money within a budget. It also promotes positive behavior and gives mommy a break from chores. There are many ways to teach your children about finance and money management and many different ways to promote positive behaviors. I hope this post has encouraged you to try some and find one that works for you and your family!